Looking to find out if Draftkings sends tax forms? Well, you’ve come to the right place! Tax time can be a bit confusing, especially when it comes to reporting your winnings from online platforms like Draftkings. But don’t worry, I’m here to break it down for you in a simple and straightforward way.

So, here’s the deal. When it comes to Draftkings, they do send tax forms if you meet certain criteria. If you’ve won more than $600 in a calendar year, Draftkings will send you a Form 1099-MISC, which reports your winnings as miscellaneous income. But what if you haven’t won that much? Well, keep reading because there’s more to it!

Now, you might be wondering why the $600 threshold is important. It all has to do with tax regulations. The IRS requires platforms like Draftkings to report winnings of $600 or more to both the player and the IRS. So, if you’re lucky enough to hit it big and exceed that amount, you can expect to receive a tax form from Draftkings. But don’t worry, reporting your winnings is an important step in staying on the right side of the law and keeping your finances in order!

If you’re wondering about the tax forms from DraftKings, here’s what you need to know. As a user, DraftKings does send tax forms if you meet certain criteria. They typically issue 1099-MISC forms for users who have won more than $600 during the year. It’s important to note that tax reporting requirements may vary based on your location and individual circumstances. For accurate information, it’s always best to consult with a tax professional.

Does Draftkings Send Tax Forms?

Welcome to our comprehensive guide on whether or not DraftKings sends tax forms. If you’re an avid fantasy sports player or sports bettor, you might be wondering about the tax implications of your winnings. In this article, we will explore whether DraftKings, one of the leading platforms in the industry, sends tax forms to its users. Understanding your tax obligations is crucial for maintaining compliance and ensuring a seamless tax filing process. So, let’s dive in and find out if DraftKings sends tax forms to its users.

1. Understanding DraftKings and Taxes

Before we discuss whether DraftKings sends tax forms, let’s first understand the relationship between gambling winnings and taxes. In the United States, gambling winnings are considered taxable income by the Internal Revenue Service (IRS). This includes winnings from fantasy sports and sports betting. Therefore, if you have won money on DraftKings, you are required to report those winnings on your federal tax return.

It’s important to note that DraftKings, like other platforms, does not withhold taxes from your winnings. As a player, it is your responsibility to keep track of your winnings and report them accurately on your tax return. Failure to report gambling income can result in penalties and legal consequences. Now that we have a basic understanding of the taxation aspect, let’s explore DraftKings’ approach to tax forms.

*Bullet point Benefits*

– Accurate reporting and compliance with tax laws.

– Avoidance of penalties and legal consequences.

– Understanding the tax implications of gambling winnings.

2. Does DraftKings Send Tax Forms?

Yes, DraftKings does send tax forms to its users under certain conditions. According to DraftKings’ official website, they will provide Form 1099-MISC to users who have accrued at least $600 in net winnings during the calendar year. This form is used to report miscellaneous income to the IRS. If you meet the income threshold, DraftKings will send you a copy of Form 1099-MISC by January 31st of the following year.

However, it’s important to note that DraftKings may not send you a tax form if you do not meet the $600 threshold. In this case, you are still required to report your winnings and accurately calculate your gambling income. The absence of a tax form does not exempt you from your tax obligations. Remember to keep thorough records of your winnings and losses for tax purposes.

*Bullet point Benefits*

– Clear understanding of the minimum threshold for receiving tax forms.

– Responsibility to accurately report winnings even without a tax form.

– Need to keep thorough records of winnings and losses.

3. Tips for Handling Taxes on DraftKings Winnings

Filing taxes can be a complex and stressful process, especially when it comes to gambling income. Here are some tips for handling taxes on your DraftKings winnings:

A. Keep Detailed Records

To accurately report your gambling income, it’s essential to keep detailed records of your winnings, losses, and expenses related to gambling. You should document each transaction, including entry fees, prizes won, and any other relevant information. Good record-keeping will help you calculate your net winnings and demonstrate transparency to the IRS, if necessary.

B. Familiarize Yourself with IRS Guidelines

Make sure to familiarize yourself with the specific IRS guidelines for reporting gambling winnings. The IRS provides detailed instructions in Publication 525, “Taxable and Nontaxable Income.” Understanding the rules and regulations will help you avoid mistakes, penalties, and any potential audits.

C. Seek Professional Assistance

If you are unsure about how to properly report your gambling income or have complex tax situations, it’s advisable to seek professional assistance. Tax professionals who specialize in gambling income can provide expert guidance and ensure that you accurately report your winnings while maximizing deductions within the legal framework.

*Bullet point Benefits*

– Importance of keeping detailed records for accurate reporting.

– Familiarity with IRS guidelines to avoid mistakes and penalties.

– Seeking professional assistance for complex tax situations.

Other Related Information

DraftKings Tax Requirements and Reporting

To ensure compliance with tax laws and maintain transparency, it’s crucial for users to understand the tax requirements and reporting obligations on DraftKings. Here, we will explore additional information on how to handle taxes related to DraftKings winnings.

Reporting Gambling Income

Reporting gambling income, including winnings from DraftKings, is a requirement by the IRS. In this section, we will provide a detailed overview of how to report your gambling income accurately and ensure compliance with tax laws.

Benefits of Accurately Reporting DraftKings Winnings

Accurately reporting your DraftKings winnings has several benefits, both in terms of legal compliance and personal financial management. Let’s explore the advantages of accurately reporting your winnings and the potential consequences of failing to do so.

How to Calculate Net Winnings from DraftKings

Calculating net winnings from DraftKings is an essential step in accurately reporting your gambling income. In this section, we will guide you through the process of calculating your net winnings and understanding the factors that impact your taxable income.

Common Mistakes to Avoid When Handling DraftKings Taxes

Handling taxes on DraftKings winnings can be complex, and there are common mistakes that many users make. To help you avoid these pitfalls, we have compiled a list of common mistakes to watch out for and tips on how to steer clear of them.

Benefits of Seeking Professional Assistance for DraftKings Taxes

Seeking professional assistance for your DraftKings taxes can provide numerous benefits, from saving time and minimizing mistakes to maximizing deductions and ensuring compliance with tax regulations. Here, we will discuss the advantages of consulting a tax professional for your DraftKings tax obligations.

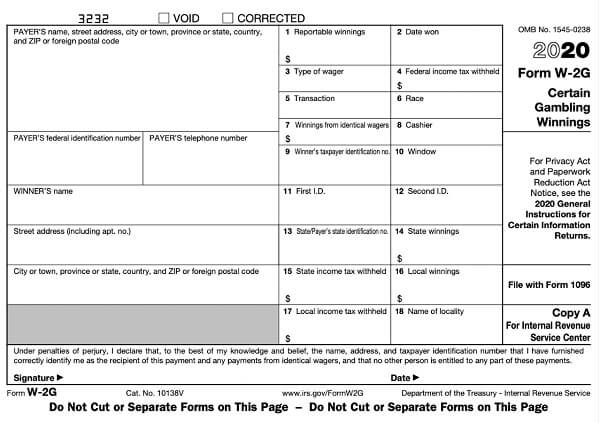

DraftKings Tax Forms: A Step-by-Step Guide

If you have received a tax form from DraftKings or are expecting one, it’s essential to understand how to navigate the process. In this section, we will provide a step-by-step guide on how to handle DraftKings tax forms and ensure accurate reporting of your gambling income.

Conclusion

Understanding the tax implications of your DraftKings winnings is crucial for staying compliant with tax laws. While DraftKings does send tax forms to users who meet the income threshold, it’s important to note that even without a tax form, you are still required to report your gambling income. Keeping detailed records, familiarizing yourself with IRS guidelines, and seeking professional assistance can help you navigate the tax reporting process smoothly. Remember to always stay informed and proactive when it comes to your tax obligations for your DraftKings winnings.

Key Takeaways: Does Draftkings Send Tax Forms?

– Draftkings does send tax forms called 1099-MISC if your winnings exceed certain thresholds.

– You may receive a tax form from Draftkings if you’ve won at least $600 or more in a calendar year.

– It’s important to report your gambling winnings on your tax return even if you didn’t receive a tax form from Draftkings.

– Keep track of your winnings and losses throughout the year to accurately report them on your taxes.

– Consult a tax professional or use tax preparation software to ensure you’re correctly reporting your gambling income.

Frequently Asked Questions

Are you confused about whether or not DraftKings sends tax forms? We’ve got you covered! Check out these commonly asked questions to help clear things up.

1. Can I expect to receive tax forms from DraftKings?

DraftKings follows the IRS guidelines, so if your winnings meet certain criteria, you can expect to receive a Form 1099-MISC. This form reports your total winnings for the year. Keep in mind that the threshold for receiving tax forms from DraftKings is $600 or more in winnings, so if your earnings fall below this amount, you likely won’t receive a tax form.

It’s essential to remember that even if you don’t receive a tax form, you are still required to report your winnings and pay taxes on them. The IRS considers all gambling winnings, regardless of whether or not you receive a tax form, as taxable income.

2. How will I receive my tax form from DraftKings?

If you meet the requirements to receive a tax form from DraftKings, you can expect to receive it via mail. DraftKings will mail the Form 1099-MISC, reporting your total winnings, to the address provided in your account. It’s crucial to keep your address up to date to ensure you receive your tax form.

Make sure to keep an eye on your mailbox during tax season and be on the lookout for the Form 1099-MISC from DraftKings. Keep in mind that it may take some time for the tax form to arrive, so if you haven’t received it by mid-February, it’s a good idea to reach out to DraftKings customer support for assistance.

3. What should I do if I haven’t received a tax form from DraftKings?

If you meet the requirements to receive a tax form from DraftKings but haven’t received one, there are a few steps you can take. First, double-check that your address is correct in your DraftKings account. If your address is correct, you can reach out to DraftKings customer support and let them know that you haven’t received your tax form.

DraftKings customer support will be able to assist you in ensuring that your tax form is resent or providing you with the necessary information to accurately report your winnings on your tax return. Remember, it’s crucial to report your winnings, even if you haven’t received a tax form, to avoid any potential issues with the IRS.

4. Do I have to pay taxes on my DraftKings winnings?

Yes, you are required to pay taxes on your DraftKings winnings. The IRS considers gambling winnings as taxable income. If you receive a Form 1099-MISC from DraftKings, that amount will be reported on your tax return, and you will be responsible for paying taxes on that income.

If you do not receive a tax form, you are still legally obligated to report all gambling winnings on your tax return. The IRS expects individuals to report all income, regardless of whether or not they receive a tax form documenting their earnings.

5. Are there any deductions I can claim on my DraftKings winnings?

While you must pay taxes on your DraftKings winnings, you may be eligible to claim certain deductions to reduce your tax liability. For example, if you had any gambling losses throughout the year, you can deduct those losses from your winnings.

However, it’s important to note that you can only deduct your losses up to the amount of your winnings. Additionally, you must keep detailed records of your gambling activity, including wins and losses, to accurately report and claim deductions. Consult with a tax professional or use tax software to ensure you are claiming any eligible deductions properly.

Summary

So, to wrap it up, Draftkings does send tax forms to users who meet certain criteria. If you win big, they’ll send you a 1099-MISC form. But don’t worry, if your winnings don’t meet the threshold, you won’t receive any forms. Just make sure to keep track of your winnings and report them when you file your taxes. Stay informed and happy gaming!